Details about your banking relationship with us.

Below is a quick summary of the general disclosures. Clicking on a section will take you to the appropriate section of the actual disclosure. If you have any questions or concerns, please contact us and we will be happy to help.

Your Ability to Withdraw Funds

In general, most BankFive deposits will be available on the next business day. For processing, Saturday, Sundays, and Federal holidays are not considered business days. For some types of deposits, funds may not be available until the second business day after the day of deposit. If this happens, we will notify you at the time of deposit when the funds will be available.

Electronic Fund Transfers Rights and Responsibilities

This section highlights the types of Electronic Fund Transfers we are capable of handling. Please read this disclosure carefully because it tells you your rights and obligations for the transactions listed. You should keep notice of this for future reference.

Transaction Limits and Fees

Please click here to view the list of fees that may be assessed to your account and the transaction limitations, if any, that apply to your account.

Signature Card Addendum

Online Banking/Bill Pay Agreement and Disclosure

This section outlines the online banking agreement, including consent to electronic notices, bill pay processing, transfers, security, errors, unauthorized transactions, electronic documents and other terms.

Substitute Checks and Your Rights

This section highlights when you may receive a substitute check in lieu of the original.

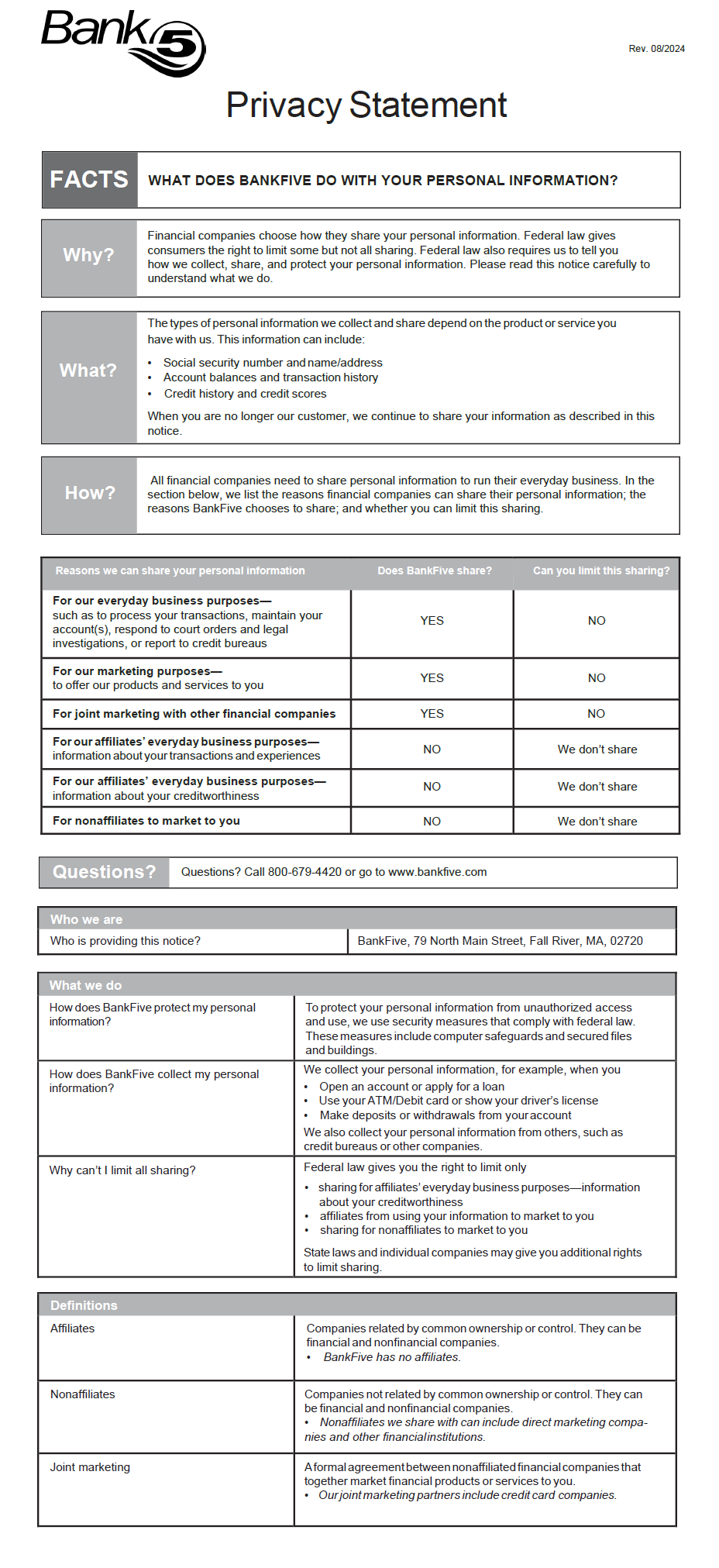

Privacy Statement

This is a copy of our privacy statement for your records.

IMPORTANT ACCOUNT INFORMATION FOR OUR CUSTOMERS

From

BankFive

79 North Main Street

Fall River, MA 02720

(774) 888-6100

YOUR ABILITY TO WITHDRAW FUNDS

This policy statement applies to all deposit accounts. Our policy is to make funds from your cash and check deposits available to you on the first business day after the day we receive your deposit. Cash, electronic direct deposits, wire transfers, checks drawn on BankFive, US Treasury checks, Cashier's certified, teller's checks, Federal Reserve Bank checks, Federal Home Loan Bank checks, postal money orders, state, and local government checks payable to you and deposited in person to an employee of the institution will be available on the same day we receive the deposit. Cash, Cashier's certified teller's checks, Federal Reserve Bank checks, Federal Home Loan Bank checks, state and local government checks and postal money orders, not deposited in person to an employee of the institution, will be made available on the next business day. Once the funds are available, you can withdraw them in cash, and we will use the funds to pay checks that you have written. Please remember that even after we have made funds available to you and you have withdrawn the funds, you are still responsible for checks you deposit that are returned to us unpaid and for any other problems involving your deposit. For determining the availability of your deposits, every day is a business day, except Saturdays, Sundays, and federal holidays. If you make a deposit before closing on a business day that we are open, we will consider that day to be the day of your deposit. However, if you make a deposit after closing, or on a day we are not open, we will consider that the deposit was made on the next business day we are open. If you make a deposit at an ATM before 6:00 p.m. on a business day that we are open, we will consider that day to be the day of your deposit. However, if you make a deposit at an ATM after 6:00 p.m. or on a day we are not open, we will consider that the deposit was made on the next business day we are open. If we cash a check for you that is drawn on another bank, we may withhold the availability of a corresponding amount of funds that are already in your accounts. Those funds will be available at the time funds from the check we cashed would have been available if you had deposited it. If we accept for deposit a check that is drawn on another bank, we may make funds from the deposit available for withdrawal immediately but delay your availability to withdraw a corresponding amount of funds that you have on deposit in another account with us. The funds in the other account would then not be available for withdrawal until the time periods that are described elsewhere in this disclosure for the type of check that you deposited.

Longer Delays May Apply

Case-By-Case Delays - In some cases, we will not make all of the funds that you deposit by check available to you on the first business day after the day of your deposit. Depending on the type of check that you deposit, funds may not be available until the second business day after the day of your deposit. The first $275 of your deposits, however, will be available on the first business day. If we are not going to make all of the funds from your deposit available on the first business day after we receive your deposit, we will notify you at the time you make your deposit. We will also tell you when the funds will be available. If your deposit is not made directly to one of our employees, or if we decide to take this action after you have left the premises, we will mail you the notice by the day after we receive your deposit. If you will need the funds from a deposit right away, you should ask us when the funds will be available.

Safeguard Exceptions - Funds you deposit by check may be delayed for a longer period under the following circumstances:

- We believe a check you deposit will not be paid.

- You deposit checks totaling more than $6,725 on any one day.

- You re-deposit a check that has been returned unpaid.

- You have overdrawn your account repeatedly in the last six months.

- There is an emergency, such as failure of computer or communications equipment.

We will notify you if we delay your ability to withdraw funds for any of these reasons, and we will tell you when the funds will be available. They will generally be available no later than the fifth business day after the day of your deposit.

Deposits at Automated Teller Machines/Mobile Deposit - Funds from any deposits (cash or checks) made at automated teller machines (ATMs) we own or operate, or through our mobile app, will be available on the second business day after the day of deposit, except that U.S. Treasury checks that are payable to you will be available on the first business day after the day of deposit. Also, the first $275 of a deposit made at ATMs we own or operate, or through our mobile app, will be available on the first business day after the day of deposit. Checks drawn on us or on a branch of ours will be available on the first business day after the day of deposit if the deposit is made at an ATM located on our premises, or through our mobile app.

Special Rules for New Accounts - If you are a new customer, the following special rules will apply during the first 30 days your account is open. Funds from deposits of cash deposited in person to an employee at the institution, wire transfers, checks drawn on BankFive and electronic direct deposits, will be available to you the same day we receive the deposit. The first $6,725 of a day's total deposits of cashier's, certified, teller's, travelers, and federal, state, and local government checks will be available on the next business day after the day of your deposit, if the deposit meets certain conditions. For example, the checks must be payable to you. The excess over $6,725 will be available on the fifth business day after the day of your deposit. If your deposit of these checks (other than a U.S. Treasury check) is not made in person to one of our employees, the first $6,725 will not be available until the second business day after the day of your deposit. The excess over $6,725 will be available on the fifth business day after the day of your deposit.

Funds from all other check deposits will be available on the second business day after the day of your deposit.

ELECTRONIC FUND TRANSFERS RIGHTS AND RESPONSIBILITIES

Indicated below are types of Electronic Fund Transfers we are capable of handling, some of which may not apply to your account. Please read this disclosure carefully because it tells you your rights and obligations for the transactions listed. You should keep this notice for future reference.

Health Savings Accounts (HSA) - We permit you (as described below) to access your HSA with a card. This service is offered for the convenience of managing your HSA. However, electronically accessing your HSA - for example, getting additional cash back on an HSA debit card transaction - can raise a variety of tax concerns. As a result, before electronically accessing your HSA make sure you are using the correct card. Also, it is your responsibility to ensure the contributions, distributions, and other actions related to your HSA, comply with the law, including federal tax law. As always, we recommend consulting a legal or tax professional if you have any questions about managing your HSA. The terms of this disclosure are intended to work in conjunction with the HSA Agreement provided to you earlier. In the event of a conflict, the terms of the HSA Agreement control. You understand that your HSA is intended to be used for payment of qualified medical expenses. It is your responsibility to satisfy any tax liability resulting from use of your HSA for any purpose other than payment or reimbursement of qualified medical expenses. We do not monitor the purpose of any transaction to or from your HSA. Nor are we responsible for ensuring your eligibility for making contributions or ensuring withdrawals are used for payment or reimbursement of qualified medical expenses. Refer to your HSA Agreement for more information relating to the use of your HSA.

Electronic Fund Transfers Initiated by Third Parties - You may authorize a third party to initiate electronic fund transfers between your account and the third party's account. These transfers to make or receive payment may be one-time occurrences or may recur as directed by you. These transfers may use the Automated Clearing House (ACH) or other payments network. Your authorization to the third party to make these transfers can occur in a number of ways. For example, your authorization to convert a check to an electronic fund transfer or to electronically pay a returned check charge can occur when a merchant provides you with notice and you go forward with the transaction (typically, at the point of purchase, a merchant will post a sign and print the notice on a receipt). In all cases, these third-party transfers will require you to provide the third party with your account number and financial institution information. This information can be found on your check as well as on a deposit or withdrawal slip. Thus, you should only provide your financial institution and account information (whether over the phone, the Internet, or via some other method) to trusted third parties whom you have authorized to initiate these electronic fund transfers.

Examples of these transfers include, but are not limited to:

- Preauthorized credits - You may make arrangements for certain direct deposits (for example, from: U.S. Treasury, ABC Company) to be accepted into your checking, savings or certificates of deposit.

- Preauthorized payments - You may make arrangements to pay certain recurring bills from your checking or statement savings.

- Electronic check conversion - You may authorize a merchant or other payee to make a one-time electronic payment from your checking account using information from your check to pay for purchases or pay bills.

- Electronic returned check charge - You may authorize a merchant or other payee to initiate an electronic funds transfer to collect a charge in the event a check is returned for insufficient funds.

Phone 5 Direct transactions - You may access your account by telephone using your account number(s), personal identification number (PIN), social security number and touch tone phone to:

- transfer funds from checking or statement savings to any transaction account

- make payments from checking or statement savings to BankFive loans or lines of credit

- get balance information about checking, savings, or certificate of deposit

- get withdrawal history about checking or savings

- get deposit history about checking, savings, or certificate of deposit

- get transaction history about checking, savings, or certificate of deposit

You may access your account for telephone transactions at the following number(s) and during the following hours:

- (888) 833-5595 (24 hours)

BankFive ATM transactions - You may access your account(s) by ATM using your BankFive ATM card and your personal identification number (PIN) to:

- deposit funds to checking or statement savings

- withdraw cash from checking or statement savings

- transfer funds from checking or statement savings to statement savings or checking

- make payments from checking or statement savings to BankFive loans

- get balance information about checking or statement savings

Some of these services may not be available at all terminals.

BankFive Visa Debit card ATM transactions - You may access your account(s) by ATM using your BankFive Visa Debit card and your personal identification number (PIN) (as applicable) to:

- deposit funds to checking or statement savings

- withdraw cash from checking or statement savings

- transfer funds from any transaction account to all transaction accounts

- make payments from any transaction account to BankFive loans

- get balance information about checking or statement savings

- get transaction history about checking or statement savings

Some of these services may not be available at all terminals.

BankFive Interactive Teller Machine (ITM) transactions - You may access your account(s) by ITM using your BankFive ATM/Debit card and your personal identification number (PIN) to:

- deposit funds to checking or statement savings (with cash back option)

- withdraw cash from checking or statement savings

- transfer funds from checking or statement savings to statement savings or checking

- make payments from checking or statement savings to BankFive loans; you may also use cash or checks to make BankFive loan payments

- get balance information about checking or statement savings, including mini statements

ITM machines also have teller assist capability. Teller assist transactions are not considered electronic fund transfers and are not covered by this Reg E Disclosure.

Some of these services may not be available at all terminals.

BankFive Visa Debit card point-of-sale transactions - You may access your checking account(s) using your BankFive Visa Debit card to do transactions that participating merchants will accept, including:

- purchase goods in person, by phone, or online

- pay for services in person, by phone, or online

- get cash from a participating merchant or financial institution

Currency Conversion and International Transactions- When you use your VISA® debit card at a merchant that settles in currency other than US dollars, the charge will be converted into the US dollar amount. The currency conversion rate used to determine the transaction amount in US dollars is either a rate selected by Visa from the range of rates available in wholesale currency markets for the applicable central processing date, which rate may vary from the rate Visa itself receives, or the government-mandated rate in effect for the applicable central processing date. The conversion rate in effect on the processing date may differ from the rate in effect on the transaction date or posting date. Visa USA charges us a .8% International Service Assessment on all international transactions, regardless of whether there is a currency conversion. If there is a currency conversion, the International Service Assessment is 1% of the transaction. The fee we charge you for international transactions/currency conversions is disclosed separately. An international transaction is a transaction where the country of the merchant is outside the USA.

Advisory Against Illegal Use - You agree not to use your BankFive Visa Debit card for illegal gambling or other illegal purposes. Display of a payment card logo by, for example, an online merchant does not necessarily mean that transactions are lawful in the jurisdiction in which you may be located.

Non-Visa Debit Transaction Processing - We have enabled non-Visa debit transaction processing. This means you may use your BankFive Visa Debit card on a PIN-Debit Network* (a non-Visa network) without using a PIN. The non-Visa debit network(s) for which such transactions are enabled are: NYCE Network or PLUS Network. Examples of the types of actions that you may be required to make to initiate a Visa transaction on your BankFive Visa Debit card include signing a receipt, providing a card number over the phone or via the Internet, or swiping the card through a point-of-sale terminal. Examples of the types of actions you may be required to make to initiate a transaction on a PIN-Debit Network include initiating a payment directly with the biller (possibly via telephone, Internet, or kiosk locations), responding to a logo displayed at a payment site and choosing to direct payment through that network, and having your identity verified using known information derived from an existing relationship with you instead of through use of a PIN. The provisions of your agreement with us relating only to Visa transactions are not applicable to non-Visa transactions. For example, the additional limits on liability (sometimes referred to as Visa's zero-liability program) and the streamlined error resolution procedures offered on Visa debit card transactions are not applicable to transactions processed on a PIN-Debit Network.

*Visa Rules generally define "PIN-Debit Network" as a non-Visa debit network that typically authenticates transactions by use of a personal identification number (PIN) but that is not generally known for having a card program.

BankFive Online Banking - You may access your accounts at www.bankfive.com by entering your username and password to:

- transfer funds from checking, statement savings to any transaction account

- make payments from any checking account to third parties

- get balance information about checking, savings, certificate of deposit, or line of credit

- get withdrawal history about checking, savings, certificate of deposit, or line of credit

- get deposit history about checking, savings, certificate of deposit, or line of credit

- get transaction history about checking, savings, certificate of deposit, or line of credit

BankFive Online Bill Pay - You may access this service by computer at www.bankfive.com and using your username and password. You may access this service to:

- make payments from your checking account(s) to any third party

- funds may be transferred from checking account or statement savings accounts to any other transaction account, including accounts held at other institutions.

BankFive Mobile Banking - You may access your accounts remotely with your cell phone or other mobile access device and using your user identification name, password, and multifactor authentication and text messaging commands (available separately). You may use this service to:

- transfer funds from checking or statement savings to statement savings or checking

- make payments from checking or statement savings to BankFive loans or lines of credit

- get balance information about checking, savings, lines of credit, or certificates of deposit

- get withdrawal history about checking or savings

- get deposit history about checking, savings, or certificate of deposit

- get transaction history about checking, savings, or certificate of deposit

Your mobile service provider's standard service fees, such as text message fees or similar charges, will apply to all transactions. Check with your service provider for information about these fees.

Limits and fees - Please refer to our fee disclosure for information about fees and limitations that may apply to these electronic fund transfers.

ATM Operator/Network Fees - When you use an ATM not owned by us, you may be charged a fee by the ATM operator, or any network used (and you may be charged a fee for a balance inquiry even if you do not complete a fund transfer).

Termination - You may terminate the electronic fund transfer agreement by giving us written notice. For transfers you preauthorize with a third party, you should revoke authorization by appropriate notice to the third party. We may terminate the electronic fund transfer agreement by notifying you at our discretion.

Option To Limit Cash Withdrawals - In addition to any dollar limitations for withdrawals that we may establish, you have the option to limit the amount of cash that can be withdrawn using your BankFive ATM or BankFive Visa Debit card to $50 per day or some other amount acceptable to us.

Minimum account balance - We do not require you to maintain a minimum balance in any account as a condition of using an access device (such as a card or code) to accomplish a transfer.

Documentation

Terminal transfers - You can get a receipt at the time you make a transfer to or from your account using an automated teller machine or point-of-sale terminal. However, you may not get a receipt if the amount of the transfer is $15 or less.

Preauthorized credits - If you have arranged to have direct deposits made to your account at least once every 60 days from the same person or company:

- the person or company making the deposit will tell you every time they send us the money.

- you can call us at (774) 888-6100 to find out whether or not the deposit has been made.

Periodic statements - You will get a monthly account statement from us for your checking, statement savings or certificates of deposit account(s).

For passbook accounts, if the only possible electronic transfers to or from your account are pre-authorized credits, we do not send periodic statements. You may bring your passbook to us, and we will record any electronic deposits that were made since the last time you brought in your passbook.

Preauthorized Payments

Right to stop payment and procedure for doing so - If you have told us in advance to make regular payments out of your account, you can stop any of these payments. Here is how: Call or write us at the telephone number or address listed in this disclosure in time for us to receive your request three business days or more before the payment is scheduled to be made. If you call, we may also require you to put your request in writing and get it to us within 14 days after you call.

Notice of varying amounts - If these regular payments may vary in amount, the person you are going to pay will tell you, 10 days before each payment, when it will be made and how much it will be. (You may choose instead to get this notice only when the payment would differ by more than a certain amount from the previous payment, or when the amount would fall outside certain limits that you set.)

Liability for failure to stop payment of preauthorized transfer - If you order us to stop one of these payments three business days or more before the transfer is scheduled, and we do not do so, we will be liable for your losses or damages.

Additional Information Required by Massachusetts Law

- Any documentation provided to you which indicates that an electronic fund transfer was made to another person shall be admissible as evidence of the transfer and shall constitute prima facie proof that the transfer was made.

- The initiation by you of certain electronic fund transfers from your account will effectively eliminate your ability to stop payment of the transfer.

Unless otherwise provided in this agreement, you (the consumer) may not stop payment of electronic fund transfers, therefore you should not employ electronic access for purchases or services unless you are satisfied that you will not need to stop payment.

Financial Institution's Liability

If we do not complete a transfer to or from your account on time or in the correct amount according to our agreement with you, we will be liable for your losses or damages. However, there are some exceptions. We will not be liable, for instance:

- If, through no fault of ours, you do not have enough money in your account to make the transfer.

- If you have an overdraft line and the transfer would go over the credit limit.

- If the automated teller machine where you are making the transfer does not have enough cash.

- If the terminal or system was not working properly and you knew about the breakdown when you started the transfer.

- If circumstances beyond our control (such as fire or flood) prevent the transfer, despite reasonable precautions that we have taken.

- If the funds are subject to legal process or other encumbrance restricting such transfer.

- There may be other exceptions stated in our agreement with you.

Confidentiality

In order that your privacy may be protected, we will not disclose any information about you or your account to any person, organization, or agency except:

- for certain routine disclosures necessary for the completion of a transfer

- for verification of the existence and condition of your account for a credit bureau or merchant

- to persons authorized by law in the course of their official duties

- to our employees, auditors, service providers, attorneys, or collection agents in the course of their duties

- pursuant to a court order or lawful subpoena

- to a consumer reporting agency as defined in Chapter 93 of Massachusetts General Laws

- by the account holder's written authorization, which shall automatically expire 45 days after receipt of account holder authorization.

If an unauthorized disclosure has been made, we must inform you of the particulars of the disclosure within three days after we have discovered that an unauthorized disclosure has occurred.

Unauthorized Transfers

- Consumer liability

- Generally. Tell us AT ONCE if you think your card and/or your code has been lost, stolen, used without your permission, or if you believe that an electronic fund transfer has been made without your permission using information from your check. Telephoning is the best way, if any, of minimizing your possible losses. You can lose no more than $50 if you fail to give us notice of your lost or stolen card and/or code and your card and/or code is used without your permission.

- Additional Limit on Liability for VISA® card. Unless you have been grossly negligent or have engaged in fraud, you will not be liable for any unauthorized transactions using your lost or stolen VISA card. This additional limit on liability does not apply to ATM transactions or to transactions using your Personal Identification Number which are not processed by VISA.

- Contact in event of unauthorized transfer.

- If you think your card and/or code has been lost, stolen or that someone has transferred or may transfer money from your account without your permission, for example, by using the information from your check, call or write us at the telephone number or address listed in this disclosure.

Protected Consumer Use

Chapter 167B of the Massachusetts General Laws was enacted to provide a means for financial institutions, businesses, and consumers to conduct their business relations more conveniently. Transferring funds electronically will supplement the use of checks, credit, and cash and will not replace these present methods of doing business. As a consumer, you should be aware of your rights if you choose to utilize this system.

(1) Prohibition of compulsory use.

No person may:

- require you to use a preauthorized electronic fund transfer as a condition of the extension of credit unless the credit is being extended in connection with an overdraft checking plan, or is being extended to maintain a specified balance in your account

- require you either to accept a transfer service or to establish an account which is accessed electronically as conditions of employment or receipt of governmental benefit

- require you to pay electronically for the purchase of goods or services

If your account is to be credited by a preauthorized transfer you may choose the financial institution to which the transfer may be made, if the institution is technically capable of receiving such preauthorized transfer.

(2) Waiver of rights. No writing or agreement signed by you can waive the rights conferred to you by Chapter 167B of the Massachusetts General Laws unless you decide to waive these rights in settlement of a dispute or action.

(3) Refunds. If it is the policy of a store or retail business to give cash refunds in return for an item purchased by cash, then this policy must also cover refunds for items purchased by electronic fund transfer unless it is clearly disclosed at the time the transaction is consummated that no cash or credit refunds are given for payments made by electronic fund transfers.

(4) Suspension of obligations. If a person agrees to accept payment by means of an electronic fund transfer and the system malfunctions preventing such a transfer, then the consumer's obligation is suspended until the transfer can be completed, unless that person, in writing, demands payment by other means.

(5) Prohibited means of identification. Your Social Security number cannot be used as the primary identification number although it can be used as secondary aid to identify you.

(6) Criminal liability. Procuring or using a card, code, or other means of electronic access to an account with the intent to defraud is a basis for criminal liability.

Error Resolution Notice

In case of errors or questions about your electronic transfers, call or write us at the telephone number or address listed in this disclosure, as soon as you can, if you think your statement or receipt is wrong or if you need more information about a transfer listed on the statement or receipt. We must hear from you no later than 60 days after we sent the FIRST statement on which the problem or error appeared.

- Tell us your name and account number (if any).

- Describe the error or the transfer you are unsure about, and explain as clearly as you can why you believe it is an error or why you need more information.

- Tell us the dollar amount of the suspected error.

If you tell us verbally, we may require that you send us your complaint or question in writing within 10 business days.

We will determine whether an error occurred within 10 business days (5 business days for point-of-sale transactions processed by Visa and 20 business days if the transfer involved a new account) after we hear from you and will correct any error promptly. If we need more time, however, we may take up to 45 days (90 days if the transfer involved a new account, a point-of-sale transaction, or a foreign-initiated transfer) to investigate your complaint or question. If we decide to do this, we will credit your account within 10 business days (5 business days if the transfer involved a point-of-sale transaction and 20 business days if the transfer involved a new account) for the amount you think is in error, so that you will have the use of the money during the time it takes us to complete our investigation. If we ask you to put your complaint or question in writing and we do not receive it within 10 business days, we may not credit your account. Your account is considered a new account for the first 30 days after the first deposit is made, unless each of you already has an established account with us before the account is opened.

We will inform you of the results within three business days after completing our investigation. If we decide that there was no error, we will send you a written explanation.

You may ask for copies of the documents that we used in our investigation. If you have inquiries regarding your account, please contact us at:

BankFive Retail Operations

79 North Main Street

Fall River, MA 02720-2144

PHONE: 774-888-6100

BUSINESS DAYS:

- Monday 8:45 a.m. - 4:00 p.m.

- Tuesday 8:45 a.m. - 4:00 p.m.

- Wednesday 8:45 a.m. - 4:00 p.m.

- Thursday 8:45 a.m. - 4:00 p.m.

- Friday 8:45 a.m. - 5:00 p.m.

- Holidays are not included.

Notice of ATM/Night Deposit Facility User Precautions

As with all financial transactions, please exercise discretion when using an automated teller machine (ATM) or night deposit facility. For your own safety, be careful. The following suggestions may be helpful.

- Prepare for your transactions at home (for instance, by filling out a deposit slip) to minimize your time at the ATM or night deposit facility.

- Mark each transaction in your account record, but not while at the ATM or night deposit facility. Always save your ATM receipts. Don't leave them at the ATM or night deposit facility because they may contain important account information.

- Compare your records with the account statements you receive.

- Don't lend your ATM card to anyone.

- Remember, do not leave your card at the ATM. Do not leave any documents at a night deposit facility.

- Protect the secrecy of your Personal Identification Number (PIN). Protect your ATM card as though it were cash. Don't tell anyone your PIN. Don't give anyone information regarding your ATM card or PIN over the telephone. Never enter your PIN in any ATM that does not look genuine, has been modified, has a suspicious device attached, or is operating in a suspicious manner. Don't write your PIN where it can be discovered. For example, don't keep a note of your PIN in your wallet or purse.

- Prevent others from seeing you enter your PIN by using your body to shield their view.

- If you lose your ATM card or if it is stolen, promptly notify us. You should consult the other disclosures you have received about electronic fund transfers for additional information about what to do if your card is lost or stolen.

- When you make a transaction, be aware of your surroundings. Look out for suspicious activity near the ATM or night deposit facility, particularly if it is after sunset. At night, be sure that the facility (including the parking area and walkways) is well lighted. Consider having someone accompany you when you use the facility, especially after sunset. If you observe any problem, go to another ATM or night deposit facility.

- Don't accept assistance from anyone you don't know when using an ATM or night deposit facility.

- If you notice anything suspicious or if any other problem arises after you have begun an ATM transaction, you may want to cancel the transaction, pocket your card, and leave. You might consider using another ATM or coming back later.

- Don't display your cash; pocket it as soon as the ATM transaction is completed and count the cash later when you are in the safety of your own car, home, or other secure surrounding.

- At a drive-up facility, make sure all the car doors are locked and all of the windows are rolled up, except the driver's window. Keep the engine running and remain alert to your surroundings.

- We want the ATM and night deposit facility to be safe and convenient for you. Therefore, please tell us if you know of any problem with a facility. For instance, let us know if a light is not working or there is any damage to a facility. Please report any suspicious activity or crimes to both the operator of the facility and the local law enforcement officials immediately.

TRANSACTION LIMITS AND FEES

Limits and fees - The following fees may be assessed against your account and the following transaction limitations, if any, apply to your account:

| Transaction Limits and Fees | |

|---|---|

| Account Research or Balancing Assistance (per hour) | $25.00 |

| ATM/Debit Card Replacement Fee (additional fees for expedited/overnight shipping will be charged to the customer) | $10.00 |

ATM Withdrawal Service Charge at Non-BankFive ATM BankFive may impose a $1.50 service fee at non-BankFive ATMs. Other banks may impose a surcharge for use of their ATMs as well. | $1.50 |

| ATM Card Transaction Limits | You may not exceed $500.00 in withdrawals per day at an ATM machine. You may not exceed $250.00 per day in transactions at a Point of Sale (POS). |

| Bulk Coin Order Fee | $10.00 |

| Debit Card Transaction Limits | You may not exceed $1,000.00 in withdrawals per day at an ATM machine. You may not exceed $2,500.00 per day in transactions at a Point of Sale (POS). You may also request a daily limit other than that stated in this disclosure. |

| Cashier's Check Fee to individuals 18 years or age and under and 65 years of age and over, $2.00. | $8.00 |

| Certified Check | $15.00 |

| Check Printing | Varies by style ordered |

| Coin Counting/Processing Fee (for customers) | Free up to $250; 5% fee for amounts counted in excess of $250 |

| Collection Items (per item) Collection items will be charged according to cost incurred in the collection process, if the cost exceeds the standard collection fee established by the bank. | $20.00 |

| Escheatment Fee (excludes CDs) | $50.00 |

| Foreign Check Conversion Fee | $7.00 Additional fees incurred in the collection process will be charged to the customer |

| Foreign Currency Exchange Fee(s) | Fee will range between $5.00 and $25.00 based on delivery method |

| Garnishments or Levies | $100.00 each |

| Insufficient Funds Charge (each paid item) Fee applies to overdrafts created by checks, in-person withdrawals, ATM withdrawals, or by any other electronic means, as applicable. Fee is only charged if an item is paid. No fee is charged if an item is returned not paid.

Fee to individuals 18 years of age and under and 65 years of age and over, $5.00 (each paid item) | $35.00 |

| Loan Servicing Fees | Please refer to our Loan Servicing Fee Schedule |

| Lost Passbook Fee | $10.00 |

| Medallion Signature Guarantee | $15.00 |

| Money Order Fee to individuals 18 years of age and under and 65 years of age and over, $1.00. | $5.00 |

| New Account Close-Out Fee (within 30 days of account opening; excludes CDs) | $25.00 |

| One-Time Loan Payment Fee Fee applies to loan payment requests made using BankFive's Online Loan Payment Service, or by phone. | $5.00 for each payment made using BankFive's Online Loan Payment Service $10.00 for each payment made by phone |

| Overdraft Sweep Fee (per day for sweeps from savings account or line of credit account) Fee applies to overdrafts created by checks, in-person withdrawals, ATM withdrawals, or by any other electronic means, as applicable. | $5.00 |

| Returned Deposited Item Charge | $7.14 |

| Safe Deposit Box Drilling Fee | $275.00 |

| Safe Deposit Box Late Fee (assessed monthly) | $5.00 |

| Safe Deposit Box Lost Key Fee | $20.00 |

| Safe Deposit Box Yearly Rental (10x10) | $125.00 |

| Safe Deposit Box Yearly Rental (3x10) | $60.00 |

| Safe Deposit Box Yearly Rental (3x4)* *Only available at our County Street, New Bedford Branch | $35.00 |

| Safe Deposit Box Yearly Rental (3x5) | $45.00 |

| Safe Deposit Box Yearly Rental (4x5)* *Only available at our County Street, New Bedford Branch | $45.00 |

| Safe Deposit Box Yearly Rental (5x10) | $85.00 |

| Safe Deposit Box Yearly Rental (5x5) | $45.00 |

| Signature Guarantee | $5.00 |

| Stop Payment (per item; checks, electronic transfers) Fee to individuals 18 years of age and under and 65 years of age and over, $5.00 per item | $35.00 |

| Temporary Checks (sheet of 3 checks) | $1.00 |

| Legal/Trust Review | $250.00 per request Additional fees incurred in he process will be charged to the customer |

| VISA International Service Assessment | 1% of transaction |

| Domestic Outgoing Wire Transfer | $25.00 |

| Domestic Incoming Wire Transfer | $15.00 |

| International Outgoing Wire Transfer (Foreign currency exchange rates or fees imposed by the receiving back may apply) | $35.00 |

| International Incoming Wire Transfer (in USD) | $40.00 |

| International Incoming Wire Transfer (in foreign currency) | $25.00 |

MORE DETAILED INFORMATION IS AVAILABLE ON REQUEST

SIGNATURE CARD ADDENDUM

AGREEMENT – These terms govern the operation of this account unless varied or supplemented in writing. Unless it would be inconsistent to do so, words and phrases used in this document should be construed so that the singular includes the plural and the plural includes the singular. As used in this form the words “we”, “our”, or “us” mean the financial institution and the words “you” or “your” mean the account holder(s). This account may not be transferred or assigned without our written consent.

This is a consumer account. A consumer account is opened by a natural person primarily for personal, family or household purposes or by an unincorporated non-business association of natural persons.

LIABILITY – Each of you agrees, for yourself (and the person or entity you represent if you sign as a representative of another) to the terms of this account and the schedule of charges that may be imposed. You authorize us to deduct these charges as accrued directly from the account balance. You also agree to pay additional reasonable charges we may impose for services you request which are not contemplated by this agreement. Each of you also agrees to be jointly and severally liable for any account deficit resulting from charges or overdrafts whether caused by you or another authorized to withdraw from this account, and the costs we incur to collect the deficit including to the extent permitted by law, our reasonable attorney’s fees.

FEES AND COSTS – You agree, jointly and severally, to be responsible for any and to pay all reasonable attorney’s fees and out of pocket expenses for all matters relating to your account and this Agreement, including, without limitation, reasonable fees and costs arising out of or relating to any trustee process summons or other form of attachment, any subpoena or summons, document production pursuant to a court related matter, or state and federal regulatory or investigatory request or order, in the amounts set forth on our Scheduled of Charges from time to time in effect, and Bank shall have all rights of set-off against your account for such charges. In the event the Schedule of Charges does not specifically provide for costs and fees incurred by us, you (jointly or severally, if more than one) agree to pay to us on demand (for which all set-off rights are available to us) all reasonable attorney's fees and costs incurred by us in the administration of this account, and/or this agreement, on account of our relationship with you.

DEPOSITS – Any items, other than cash, accepted for deposit (including items drawn “on us”) will be given provisional credit only until collection is final (and actual credit for deposits of, or payable in, foreign currency will be at the exchange rate in effect on final collection in U.S. dollars). We are not responsible for transactions initiated by mail or outside depository until we actually record them. All transactions received after our “daily cut-off time” on a business day we are open, or received on a day in which we are not open for business, will be treated and recorded as if initiated on the next following business day that we are open.

WITHDRAWALS – Unless otherwise clearly indicated on page 1 any one of you who signs this form including authorized signers, may withdraw or transfer all or any part of the account balance at any time on forms approved by us. Each of you (until we receive written notice to the contrary) authorizes each other person signing this form to endorse any item payable to you or your order for deposit to this account or any other transaction with us. The fact that we may honor withdrawal requests, which overdraw the finally collected account balance, does not obligate us to do so unless required by law. Withdrawals will first be made from collected funds, and we may, unless prohibited by law or our written policy, refuse any withdrawal request against uncollected funds, even if our general practice is to the contrary. We reserve the right to refuse any withdrawal or transfer request which is attempted by any method not specifically permitted, which is for an amount less than any minimum withdrawal requirement, or which exceeds any frequency limitation. Even if we honor a nonconforming request, repeated abuse of the stated limitations (if any) may eventually force us to close this account. We will use the date a transaction is completed by us (as opposed to the day you initiated it) to apply the frequency limitations. On interest-bearing accounts other than time deposits, we reserve the right to require at least seven days written notice before any withdrawal or transfer. Withdrawals from a time deposit prior to maturity or prior to the expiration of any notice period may be restricted and may be subject to penalty. See your notice of penalties for early withdrawal.

OWNERSHIP OF ACCOUNT AND BENEFICIARY DESIGNATION – These rules apply to this account depending on the form of ownership and beneficiary designation, if any.

- Individual Account - is owned by one person.

- Joint Account – With survivorship (And Not as Tenants in Common) is owned by two or more persons. Each of you intends that upon your death the balance in the account (subject to any previous pledge to which we have consented) will belong to the survivor(s). If two or more of you survive, you will own the balance in the account as joint tenants with survivorship and not as tenants in common.

- Joint Account – No Survivorship (As Tenants in Common) - is owned by two or more persons, but none of you intend (merely by opening this account) to create any right of survivorship in any other person. We encourage you to agree and tell us in writing of the percentage of the deposit contributed by each of you. This information will not, however, affect the “number of signatures” necessary for withdrawal.

- Revocable Trust Account – If two or more of you create such an account payments may be made to both of you, to either of you, or to the survivor of you, as trustee. Beneficiaries acquire the right to withdraw only if (1) the trustee dies (or if there are two trustees, both trustees die), and (2) the beneficiary is then living. If two or more beneficiaries are named and survive the death of all trustees, such beneficiaries will own this account in equal shares, without right of survivorship. The person(s) creating this account type reserves the right to: (1) change beneficiaries, (2) change account types, and (3) withdraw all or part of the deposit at any time.

- Organizational Accounts – We will usually require a separate authorization form designating the person permitted and conditions required for withdrawal from any account in the name of a legal entity such as an organization. We will honor such authorization according to its terms until it is amended or terminated in writing by the governing body of such organization.

STOP-PAYMENTS – A stop-payment order must be given in the manner required by law, must be received in time to give us a reasonable opportunity to act on it, and must precisely identify the number, date and amount of the item, and the payee. We will honor a stop-payment request by the person who signed the particular item, and, by any other person, even though such other person did not sign the item, if such other person has an equal or greater right to withdraw from this account than the person who signed the item in question. A release of the stop-payment request may be made only by the person who initiated the stop payment.

AMENDMENTS AND TERMINATION – We may change any term of this agreement. Rules governing changes in interest rates have been provided separately. For other changes we will give you reasonable notice in writing or by any other method permitted by law. We may also close this account at any time upon reasonable notice to you and tender of the account balance personally or by mail. Notice from us to any one of you is notice to all of you.

STATEMENTS – If you do not notify us of an unauthorized signature or alteration within a reasonable time (not to exceed 14 days) after we send or make available to you your statement and items: (1) you cannot assert the unauthorized signature or alteration against us, even if we are unable to show a loss due to your failure, and (2) you cannot assert any unauthorized signatures or alterations by the same wrongdoer on items paid by us after the reasonable time mentioned above elapses, but before we receive your notice. We lose these protections if we fail to exercise ordinary care in paying an item with an unauthorized signature or alteration, unless you do not notify us of the problem within 60 days of when we send or make available to you the statement and items. You must report any other problem (e.g., erroneous statement or passbook entry, missing signature, unauthorized endorsement, etc.) within this 60-day period or lose your right to assert the problem against us.

DIRECT DEPOSITS – If, in connection with a direct deposit plan, we deposit any amount in this account which should have been returned to the Federal Government for any reason, you authorize us to deduct the amount of our liability to the Federal Government from this account or from any other account you have with us, without prior notice and at any time, except as prohibited by law. We may also use any other legal remedy to recover the amount of our liability.

TEMPORARY ACCOUNT AGREEMENT - If this option is checked on page 1, this is a temporary account agreement. Each person who signs this signature card (except as indicated to the contrary on page 1) may transact business on this account. However, we may at some time in the future restrict or prohibit further use of this account if you fail to comply with the requirements we have imposed within a reasonable time.

SET-OFF - You each agree that we may (without prior notice and when permitted by law) set off the funds in this account against any due and payable debt owed to us now or in the future, by any of you having the right of withdrawal, to the extent of such persons or legal entity’s right to withdraw. If the debt arises from a note, “any due and payable debt” includes the total amount of which we are entitled to demand payment under the terms of the note at the time we set off, including any balance for the due date for which we properly accelerate under the note. This right of set-off does not apply to this account if: (a) it is an Individual Retirement Account or other tax-deferred retirement account, or (b) the debt is created by a consumer credit transaction under a credit card plan, or (c) the debtor’s right of withdrawal arises only in a representative capacity. We will not be liable for the dishonor of any check when the dishonor occurs because we set off a debt against this account. You agree to hold us harmless from any claim arising as a result of our exercise of our right of set-off.

AUTHORIZED SIGNERS (Individual Accounts only) – An authorized signer is someone to whom you give all rights to have now or in the future to make withdrawals and deposits. Merely by designating an authorized signer you do not intend to give any ownership rights in the account.

ONLINE BANKING/BILL PAY AGREEMENT AND DISCLOSURE

This Agreement and Disclosure provides information about the BankFive Online Banking and BankFive Bill Pay service. By clicking accept you agree that you have read, understood and agree to the terms and conditions set forth in the Agreement and Disclosure. You authorize your BankFive to post payment transactions generated by BankFive Bill Pay. Your use of the BankFive Bill Pay service signifies that you have read and accepted all terms and conditions of BankFive Bill Pay. If at any time you decide to discontinue service you will provide written notification to BankFive either through BankFive Online secured email or by letter mailed to BankFive, 79 N. Main St., Fall River, MA 02720.

Consent to Electronic Notices

By clicking on the “Accept” box at the end of this document, you affirmatively consent to receive, and acknowledge that you can access, receive and retain the Notices electronically or by electronic means, and not in paper or non-electronic form. You further acknowledge that by accessing the BankFive website, you satisfy the hardware and software requirements discussed more fully below and acknowledge that you have reasonably demonstrated that you can access, receive and retain the Notices electronically in the format BankFive uses.

General Information about BankFive Online Banking and BankFive Bill Pay

You may use BankFive Online Banking virtually any time, day or night, 7 days a week. However, Online Banking may be temporarily unavailable due to BankFive’s record updating, or technical difficulties. In addition, access to Online Banking is made available pursuant to a license agreement by and between BankFive Digital Insight (“DI”). Any interruption of service or access caused by DI will also prevent you from using the service. To utilize the services, you will need to enter your user ID and password and otherwise satisfy the system's security procedures.

BankFive Bill Pay is a consumer electronic banking service. You may access BankFive Online Banking and BankFive Bill pay though www.bankfive.com on the internet.

Designated Checking Account

You understand that in order to use BankFive Bill Pay, you must have a checking account with BankFive. In the event that more than one checking account is connected to your Online Banking profile, you will designate which checking account each bill pay is to be deducted from.

Business Day

BankFive 's business days are Monday thru Friday excluding any Federal Holidays. For the purpose of this document, "you," and "your" shall refer to each Depositor who signs up for Online Banking and BankFive Bill Pay. All references to time of day in this Agreement and Disclosure refer to Eastern Standard Time.

Service Available through Online Banking

The BankFive Online Banking service allows you to:

1. Access your checking account(s) to pay most bills (Bill Payments);

2. Transfer funds electronically (Transfers);

3. Obtain account information;

4. Obtain certain BankFive product and service information;

Collectively, these are referred to as the " BankFive Online Banking Service.”

Transaction Procedures

Bill Payments may be processed in three different transaction modes. They are as follows:

- "Manual”. If you designate a payment as a "today" transaction, the scheduled payment date will be the next business day. However, sufficient funds must be available on the day and at the time you request the payment to be made; typically your checking account will be debited for the transaction within two business days. Bill Payments scheduled on “today’s” date may be canceled before 9 P.M. If “today’s” date falls on a weekend or holiday the transaction will be made the next business day.

- "Scheduled”. If you designate a Bill Payment as a "scheduled" transaction, you may request that the transaction be made on a future date that you designate up to 364 days in advance. The “send on” date entered will be the effective date, if the effective date falls on a weekend or holiday the effective date shall be the next business day. Sufficient funds must be available in your designated checking account at the time the withdrawal is attempted; typically your checking account will be debited for the transaction within two business days. "Scheduled" transactions may be canceled or changed until 9 P.M. of the night before the “send on” date.

- "Automatic”. If you designate a Bill Payment as an "automatic" transaction, you may request, and BankFive Bill Pay will use, a scheduled payment date that reoccurs on a specified regular basis (i.e. weekly, biweekly, monthly, etc). You will designate a "start on" date and "end on" date. In cases were a recurring payment falls on a weekend or Federal holiday it will be processed the preceding business day. If you are setting up a recurring payment for the first time to be processed on a Saturday it will be processed on the next business day.

Bill Payments

Account Designation and Payees.

All Bill Payments you make through BankFive Bill Pay will be deducted from your designated checking account(s). Sufficient funds must be available in your designated checking account at the time the withdrawal is attempted. If a withdrawal is attempted and there are not sufficient funds in your checking account at the time, the withdrawal may be rejected and your account will be charged an Insufficient Funds fee (please refer to BankFive’s Fee Schedule).

Any payee you wish to pay through BankFive Bill Pay must be payable in U.S. dollars and located within the United States or its territories. Each payee must appear on the payee list you create before you can schedule a payment. Payments to payees outside the United States are prohibited and may not be issued under any circumstances. Tax payments to the Internal Revenue Service, or any state or other government agency, court-ordered payments (such as alimony or child support), and payments to insurance companies are by discouraged and in no event will BankFive Bill Pay be held liable for any claims for damages resulting from your scheduling prohibited or discouraged payments. The BankFive Bill Pay guarantee as it applies to any late payment related charges is void when prohibited or discouraged payments are scheduled and or processed through BankFive Bill Pay. BankFive Bill Pay has no obligation to research or resolve any claim resulting from an exception payment. All research and resolution for any misapplied, misposted or misdirected exception payments will be the sole responsibility of you and not of BankFive Bill Pay.

Processing

In many cases, your Bill Payments are electronically delivered to the payee within three business days of the Scheduled Payment Date. However, some payees are not set up to accept electronic payment. In these cases, a check will be sent, which may take up to five business days to process and deliver to the payee. BankFive Bill Pay provides an indication of how many days to allow for each payee you designate. You must allow additional time for the payee to process and record your payment prior to the due date.

You must allow sufficient time 3 or 5 business days, as indicated online for BankFive Bill Pay to receive your request and process the bill payments so that the funds can be delivered to the payee before the payment due date or, for mortgage payments, on or before the due date (the due date shown on your invoice or provided in your agreement with the payee, not taking into account any grace period provided by the payee). If you do not allow sufficient time, you will assume full responsibility for all late fees, finance charges, or other actions taken by the payee. If you schedule your payment with sufficient time, and the payment was not received by the payee, or was received late, BankFive Bill Pay will assume responsibility. BankFive Bill Pay will cover any late payment related charges up to $50.00 should a payment arrive after the “deliver by” date as long as you scheduled the transaction in accordance with BankFive Bill Pay payment guarantee policy. The reimbursement for late payment related charges will be to you and not the merchant to whom the payment was issued.

BankFive Bill Pay is responsible only for exercising ordinary care in making payments upon your authorization and for mailing or sending a payment to the designated payee. BankFive Bill Pay is not liable in any way for damages or fees you incur if you do not have sufficient funds in your account to make the payment on the processing date, if the estimate of time to allow for delivery to the payee is inaccurate, or due to delays in mail delivery, changes of merchant address or account number, the failure of any merchant to account correctly for, or credit the payment in a timely manner, or for any other circumstances beyond the control of BankFive Bill Pay.

In the event sufficient funds are not available in the designated checking account when the payment withdrawal is attempted, BankFive Bill Pay will attempt up to three times to make the withdrawal for electronic payments. If the bill payment was more than $500.00, was issued in the form of a check and there were insufficient funds when the withdrawal was attempted a stop payment will be issued and no further withdrawal attempts will be made. If an insufficient funds condition exists, your account will be charged an insufficient funds fee for each withdrawal attempt as documented in the fee schedule. As a result of the insufficient condition your bill pay account will be blocked preventing you from making more bill payments until the insufficient funds condition is resolved with BankFive Bill Pay. All scheduled payments will automatically be canceled while the block is in effect. After your Bill Pay account is unblocked, you are responsible for rescheduling canceled payments at your discretion. Any automatic recurring payments scheduled for release during the time the account is blocked will not be sent. Once the account is unblocked, any Automatic recurring payments set up for future payment in BankFive Bill Pay will still be set up in the system and will resume again. In all cases, you are responsible for making alternate arrangements for the payment. Once BankFive Bill Pay has recovered the funds owed the Bill Pay service may remain blocked for an additional 3 business days.

Expedited Bill Payments

BankFive’s Bill Pay service provides a method by which payments can be sent to payees faster than normal processing time. Only payees that qualify for an expedited payment at the time the payment is set up will appear as a choice in the list of eligible payees. Expedited payments are sent either electronically to the payee or via Overnight Check. If a payee is not set up to receive electronic payments, the only method available for that payee will be Overnight Check. There is a convenience fee associated with each type of Expedited Payment. The successful submission of an Expedited Payment will represent acceptance of applicable convenience fees associated with this service by you. The convenience fee will be withdrawn from the checking account from which the Expedited Payment is being sent. Once an Expedited Payment has been submitted, it cannot be canceled. In the event sufficient funds are not available in the designated checking account when the payment withdrawal is attempted, BankFive Bill Pay will attempt up to three times to make the withdrawal for electronic payments. If an insufficient funds condition exists, your account will be charged an insufficient funds fee for each withdrawal attempt as documented in the fee schedule. As a result of the insufficient condition your bill pay account will be blocked preventing you from making more bill payments until the insufficient funds condition is resolved with BankFive Bill Pay.

Right to Repayment

You each agree that BankFive may (without prior notice and when permitted by law) off set the funds in this account against any due and payable debt owed to BankFive now or in the future, by any of you having the right of withdrawal, to the extent of such persons or legal entity’s right to withdraw. If the debt arises from a note, “any due and payable debt” included the total amount of which BankFive is entitled to demand payment under the terms of the note at the time BankFive processes the off set, including balance and due date for which BankFive properly accelerate under the note. The right to offset does not apply to this account if: (a) it is an Individual Retirement Account or other tax-deferred retirement account, or (b) the debt is created by a consumer credit transaction under a credit card plan or (c) the debtor’s right of withdrawal arises only in a representative capacity. BankFive will not be liable for the dishonor of any check when the dishonor occurs because BankFive off set a debt against this account. You agree to hold BankFive harmless from any claim arising as a result of the right of off set.

Transfers

- Available Accounts. Transfers are limited to checking, statement savings, statement money market and certain lines of credit accounts. These accounts must first be established in Online Banking before transfers can be initiated. All the accounts must be in your name. The cutoff time for transfers to be completed same day is 8:00pm Eastern Time. Transfers initiated after 8:00pm Eastern Time will be completed the next business day.

- Funds Availability. Although you receive immediate provisional credit upon completion of your Online Banking session for internal bank transfers funds may not be available for immediate withdrawal. Transfer made on a Saturday, Sunday or Holiday will be available the next business day. Transfers scheduled on “today’s” date cannot be canceled.

Limitations on Services

- Dollar Limitations. Bill Payments cannot be initiated for more than $9,999.99 with a combined daily transaction limit set at $19,999.99 or the available balance, whichever is less, unless previously amended with BankFive.

- Transfer Limitations. Except as provided herein, all Bill Payments and Transfers to and from an account are subject to the terms and conditions applicable to such account as set forth in the account agreement governing such account.

- Available Funds Required. All Bill Payments and Transfers initiated through BankFive Online Banking and BankFive Bill Pay are subject to there being sufficient funds available in the designated account(s) to cover the payment or transfer on the scheduled payment date or when funds are attempted to be withdrawn.

Stopping or Modifying Online Banking Authorized Payments

Payments designated as "today" transactions can be stopped, canceled, or changed prior to 9 P.M. In order to request a stop payment or change a transaction scheduled for a future date or as an automatic reoccurring payment or transfer you must use BankFive Bill Pay and follow the instructions provided therein. You must cancel the payment using BankFive Bill Pay by 9 P.M. of the day before the scheduled payment date.

Authorization to Charge Accounts

You authorize BankFive Bill Pay to charge your designated account(s) for any transactions accomplished through the use of BankFive Bill Pay, including the amount of any bill payment or transfer that you make, and any charges for the service. You authorize BankFive to process Bill Payments and to transfer funds according to the instructions received from you through Online Banking. You authorize BankFive Bill Pay to initiate any reversing entry or reversing file, and to debit your accounts at BankFive or elsewhere, in order to correct any mistaken credit entry. You understand that if a bill payment or transfer request describes the beneficiary inconsistently by name and account number, execution of the request will occur on the basis of the account number, even if it identifies a person different from the named beneficiary. Further, BankFive and other financial institutions to which a bill payment or transfer request is forwarded may rely on any BankFive identification number supplied by you as a means to identify any other financial institution, even if the identification number is different than the financial institution named by you. Your obligation to pay the amount of the bill payment or transfer to BankFive is not excused in such circumstances.

Security Procedures

A temporary Online Banking password will be assigned to you. The temporary password will be used only the first time you access the service, you will then be prompted to define a new password. From time to time you will be required to change your password for security purposes. Your Online Banking username and password are confidential and should not be disclosed to anyone. You are responsible for the safekeeping of your Online Banking username and Password. You agree not to disclose or otherwise make the Online Banking username and password available to anyone. You are expected to take reasonable precautions in an effort to prevent unauthorized access to your Online Banking account including, but not limited to, installing and keeping your computer’s anti-virus, anti-phishing, and anti-spyware software up-to-date.

By using BankFive Online Banking and BankFive Bill Pay you represent that you have considered the security procedures of the BankFive Online Services and find that the security procedures are commercially reasonable for verifying that a bill payment, transfer or other communication purporting to have been issued by you is, in fact, yours. In reaching this determination, you have considered the size, type and frequency of bill payments, transfers or other communications that you anticipate issuing to BankFive.

If the BankFive Online Banking security procedures are not, in your judgment, commercially reasonable, you must inform BankFive within 30 days. If the size, type and frequency on your bill payments and transfers change, and the result is that the BankFive Online Banking security procedures cease to be commercially reasonable, you must also inform BankFive of this within 30 days as otherwise permitted in BankFive's Deposit Agreement and Disclosures, by law, or as required by government regulations.

The BankFive website may contain links to third party sites. These links and pointers to the third party sites are not part of the BankFive website. BankFive makes no representations or warranties regarding these third party sites. BankFive is not responsible for any losses or damages in connection with the information, security or privacy practices availability, content or accuracy of materials of such third party sites. These third party sites might have a privacy policy different from BankFive and third party sites may provide less security than the BankFive website. You should review their privacy and security policies before your share any non-public personal information.

Liability for Unauthorized Use

You will notify BankFive immediately if you believe that your Online Banking password has become known to an unauthorized person. Telephoning is the best way of keeping your possible losses to a minimum. If you suggest that an unauthorized transfer or payment may have occurred, you may be required to sign an affidavit and file a police report.

You could lose all the money in your deposit account(s) accessed through BankFive Online Banking (plus your maximum overdraft line of credit, if any) if you don't inform BankFive that your Online Banking password has become known to an unauthorized person. If you tell BankFive within two business days after you learn of the loss, you can lose no more than $50.00 if an unauthorized person used your Online Banking password to access without your permission.

If you do not tell BankFive within two business days after you have learned that your password has become known to an unauthorized person, and BankFive can prove that you could have stopped someone from using your BankFive Online Banking password without your permission if you had told BankFive, you could be liable for as much as $500.00.

Also, if your statement shows electronic funds transfers that you did not make, you will notify BankFive immediately. BankFive may require you to provide your complaint in the form of an affidavit and/or police report. If you do not tell BankFive within 60 days after the statement was made available to you, you may not get back any money you lost after the 60 days if BankFive can prove that BankFive could have stopped someone from taking the money if you had told BankFive in time.

Notification of Unauthorized Transaction or a Lost or Stolen Access Device

If you believe your BankFive Online Banking password has become known by an unauthorized person, or that someone has transferred money or made payments without your permission, you will call BankFive Customer Service at 774-888-6100.

Liability for Failure to Make Payments

If BankFive Bill Pay does not send a payment or make a transfer on time, or in the correct amount according to your instructions given in accordance with this Agreement and Disclosure, BankFive Bill Pay will be liable for damages caused. However, there are some exceptions. BankFive Bill Pay will not be liable, for instance, if:

- Through no fault of BankFive, your account does not contain sufficient funds to make the payment or transfer.

- The payment or transfer would go over the credit limit on your overdraft line of credit.

- The equipment, ATM network, phone lines, or computer systems were not working properly or were temporarily unavailable.

- Circumstances beyond BankFive’s scope of control, such as fire or flood, prevented the payment or transfer, despite reasonable precautions that BankFive has taken.

- A court order or legal process prevents BankFive from making a transfer or payment.

- You have a reasonable basis for believing that unauthorized use of your BankFive Online Banking password or designated account(s) have occurred or may be occurring or if you default under any agreement with BankFive or if either party terminates this Agreement.

- The payee does not process a payment correctly, or in a timely manner.

- There may be other exceptions stated in this agreement.

If any of the circumstances listed above shall occur, BankFive Bill Pay shall assist you with reasonable efforts in taking appropriate corrective action to reprocess the transactions that may not have been completed or to correct transactions that have been processed incorrectly.

Errors or Questions

You will telephone the Customer Contact Center at 774-888-6100 or write BankFive, Attention: Customer Contact Center, 79 North Main St., Fall River, MA 02720 as soon as you can, if you think your statement or receipt is wrong or if you need more information about a Bill Payment or Transfer listed on the statement or receipt. BankFive must hear from you no later than 60 days after BankFive sends the statement on which the problem or error appeared. A statement is considered to have been sent when it is first made available. You must:

- Tell BankFive your name and account number.

- Describe the error or payment you are unsure about, and explain as clearly as you can why you believe it is an error or why you need information.

- Tell BankFive the dollar amount of the suspected error.

If you tell BankFive verbally, BankFive may require that you send your complaint or question in writing within ten business days. BankFive may require you to provide your complaint in the form of an affidavit.

BankFive will inform you of the results of BankFive investigation within ten calendar days (20 calendar days if the suspected error occurred outside the United States or if it occurred at a merchant location for the purchase of goods and services) after BankFive hears from you, and will correct any error promptly. If BankFive needs more time, however, BankFive may take up to 45 calendar days (90 days if outside the United States or if it occurred at a merchant location for the purchase of goods or services) to investigate your complaint or question. If BankFive decides to do this, provisional credit will be provided to you in your account within ten calendar days (20 calendar days if the suspected error occurred outside the United States or if it occurred at a merchant location for the purchase of goods or services) for the amount you think is in error, so that you will have the use of your money during the time it takes BankFive to complete your investigation. If BankFive asks you to put your complaint or question in writing and it is not received within ten business days, BankFive may not re-credit your account.

If BankFive determines that there is no error, you will be sent a written explanation within three business days after the investigation is completed. Your account will be debited for the amount of any provisional credit applied. BankFive will honor checks, drafts, or similar instruments payable to third parties and preauthorized transfers from your account (at no charge if an overdraft results) for five business days after you receive this notification.

Other Problems

If you believe an error other than an electronic funds transfer problem has occurred concerning a deposit account or if you have a problem regarding a credit account accessed by an ATM/Debit Card, you will refer to your monthly statement for instructions regarding how to have BankFive resolve your question or correct an error.

Electronic Documents

Definitions

For the purposes of this eDocument User Agreement, "Agreement” shall refer to this User Agreement. "You”, "your” and "user” refer to the accountholder or any other individual authorized to receive electronic delivery of periodic account statements or other documents, disclosures and communications ("eDocuments”) under this Agreement. "We”, "us”, "our”, and "Bank” refers to BankFive. "BankFive Online Banking” refers to the BankFive Internet Banking and Bill Payment Service. "eDocument Delivery Service” or "the Service” refers to the BankFive eDocument Delivery Service. "Account” or "Accounts” refers to your deposit or loan accounts at BankFive.

Agreement

The eDocuments Delivery Service is provided as a service of BankFive Online Banking and therefore the Online Banking Access Agreement (Personal and/or Business), whichever is applicable to you, will be considered the controlling Agreement for the eDocument Delivery Service.